$0 deductible health insurance good or bad

These plans are best for those who are relatively healthy. Ad Get the Best 2022 Health Insurance Plans in Maryland.

How Much Should I Pay For Healthcare Healthcare Affordability Ratio

A plan without a deductible usually provides good coverage and is a smart choice for those who expect to need expensive medical care or ongoing medical treatment.

. Additionally a plan may offer only a limited network of doctors which can interfere with a patients choice. A health plan deductible is the amount you pay out of pocket before your insurance covers any cost. If its a fixed indemnity you get a fixed benefit towards every claim.

At the other extreme a gold-level. 0 deductible just means there is no deductible to satisfy before benefits kick in. It means youre likely paying a whole lot of money in premiums in order to have a false peace of mind ifwhen you go to the doctor.

The maximum out-of-pocket limit for 2022 is 8700 for individual plans and 17400 for family plans. Illinois Bright Health Bronze 0 Medical. Obviously paying 0 0 is better than paying 3k - 5k 30-50.

Employees often feel that a high deductible health plan forces them to spend more money at first because they must meet specific obligations before the full benefits begin to kick-in for them. Health Insurance With A Zero-Dollar Deductible Anytime you increase the benefit in one area of a health plan you can expect other areas to compensate to a degree. The monthly fee for your insurance.

Medicare Advantage can become expensive if youre sick due to uncovered copays. How do deductibles work. No not with your assumptions.

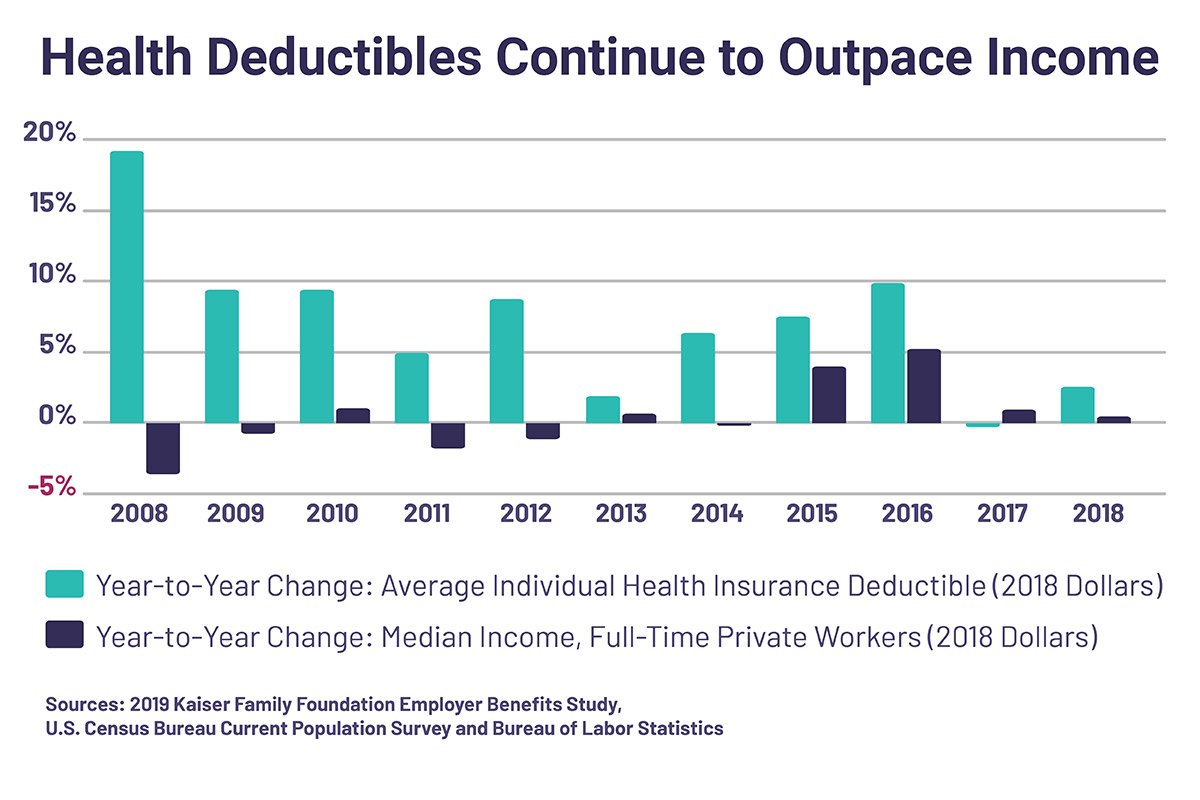

Spend declined 12 2. 1000 Out of Network. Not perfect but a start.

It scored a 75 on the Complaint Index where 10 is the average rate of complaints. These plans tend to have more comprehensive coverage but may cost a little more. Buying a no-deductible policy puts the risk solely on the insurance company.

How much you must kick in for care initially before your insurer pays anything. The monthly premium difference is not that important to me overall since the difference is so low. Another feature of a health plan is the out-of-pocket maximum or the most youll have to spend for covered services in a given year.

A 0 deductible means that youll start paying after deductible rates right away. A Unique Affordable Way to Lower Health Insurance Costs - Get Your No Obligation Quotes. A prominent study looked at the impact of High Deductible Health Plans HDHPs over a six-year period 1.

But from your question you dont even meet the lower deductible of 3000 in a typical year. Instead of having to meet that deductible youll simply move past it. On a 0 deductible plan youre paying a fee co-pay for each of these services.

A premium is what you pay every month for your plan. It just depends on the specifics of your health and finances. Here are 6 important things to know about deductibles.

Answer 1 of 8. The Bottom Line. In the complaint database from the NAIC the national company of Bright HealthCare has a complaint rate thats seven times higher than the industry average.

After all health insurance may make health care affordable - but it cant be 100 free except in a perfect world. People without insurance pay on average twice as much for care. Your cost for routine services to which your deductible does not apply.

Customer reviews and complaints. The only reason that 0 copay would be better is if you have met your deductible and then have a large expense say 10000 hospital stay. Some families avoid seeking medical treatment because of the deductible cost.

If it has a coinsurance you get a percentage covered by the company and then you owe the other percentage ex. Health insurance with no deductible is one of the most comprehensive forms of medical coverage. There are several health insurance terms to understand.

A 35000 employee group went from a Rolls Royce plan with a 0 deductible 0 out-of-pocket to a HDHP with a 1000 to 1500 health savings account contribution and a 3000 deductible. 2022 Health Ins Plans are Here. Ad Compare Medical Insurance from Top Blue Cross Blue Shields.

Bright HealthCare insurance has a high rate of dissatisfied policyholders. List of the Cons of a High Deductible Health Plan. A higher premium for a zero-deductible or low-deductible policy is the.

Is a zero-deductible plan good. Put simply having a high deductible plan or a zero deductible plan isnt bad in and of itself. Friday has plans with unlimited primary care visits 0 mental health visits and 0 generic drugs.

The good news is that the insurance company begins paying your claims right away. The cost of a no-deductible policy. Pay more for regular healthcare services.

These are federal government set limits but your plan may have a lower out-of-pocket. Some HDHPs come with HSAs attached. It is available for individuals families businesses and self-employed persons that purchase their own coverage and want little or no out-of-pocket expenses coupled with high-quality benefits.

Is a 0 deductible good. Insurance companies negotiate their rates with providers and youll pay that discounted rate. While the 0 premium may be enticing the reality is that the out-of-pocket expenses and restrictions end up making them expensive over time.

Choosing health insurance with no deductible usually means paying higher monthly costs. Ad Explore Our 2022 Medicare Advantage Plans With More Of What You Need For Less. Many plans with deductible often have cheaper regular healthcare needs than the 0 deductible plans.

A quick search on Healthcaregov reveals a family of your size in Texas could pay around 620 per month on a bronze-level PPO with a high deductible of 12700. Here is a comparison of the three health insurance options currently being offered by my wifes. Yes a zero-deductible plan means that you do not have to meet a minimum balance before the health insurance company will contribute to your health care expenses.

Out of pocket maximum. Medicare Advantage plans are not always as wonderful as they are made out to be. An insurance plan with no deductible may appeal to consumers who frequently visit.

VA healthcare and limited medical insurance plans do not have deductibles. What works for one healthcare consumer may be inadequate for another and vice versa. Thats because deductibles are designed as a way for you to share the risk of an accident with an insurer the III says.

Having health insurance can lower your costs even when you have to pay out of pocket to meet your deductible. Youll likely pay a higher premium for zero-deductible coverages. An HDHP is a plan with at least a 1400 deductible for an individual or a 2800 deductible for a family in 2022.

A Blue Cross Blue Shield Plan From NJ Health Care Leaders. There are also major medical plans with an upfront cost of 0 called no-deductible plans. Compare Updated Medical Insurance Pricing.

Depending on the plan this will likely mean lower out of pocket costs for services. Start With Your Zip Code. Zero-deductible plans typically come with higher premiums whereas high-deductible plans come with lower monthly premiums.

The percentage you must pay for care after youve met your deductible. Most medical care performed out of network is not covered. The bad news is that you pay higher monthly premiums and still share costs through copays and coinsurance.

All You Need To Know About Health Insurance Deductibles Goodrx

Health Insurance Basics How To Understand Coverage

What To Do When You Can T Pay Your Health Insurance Deductible

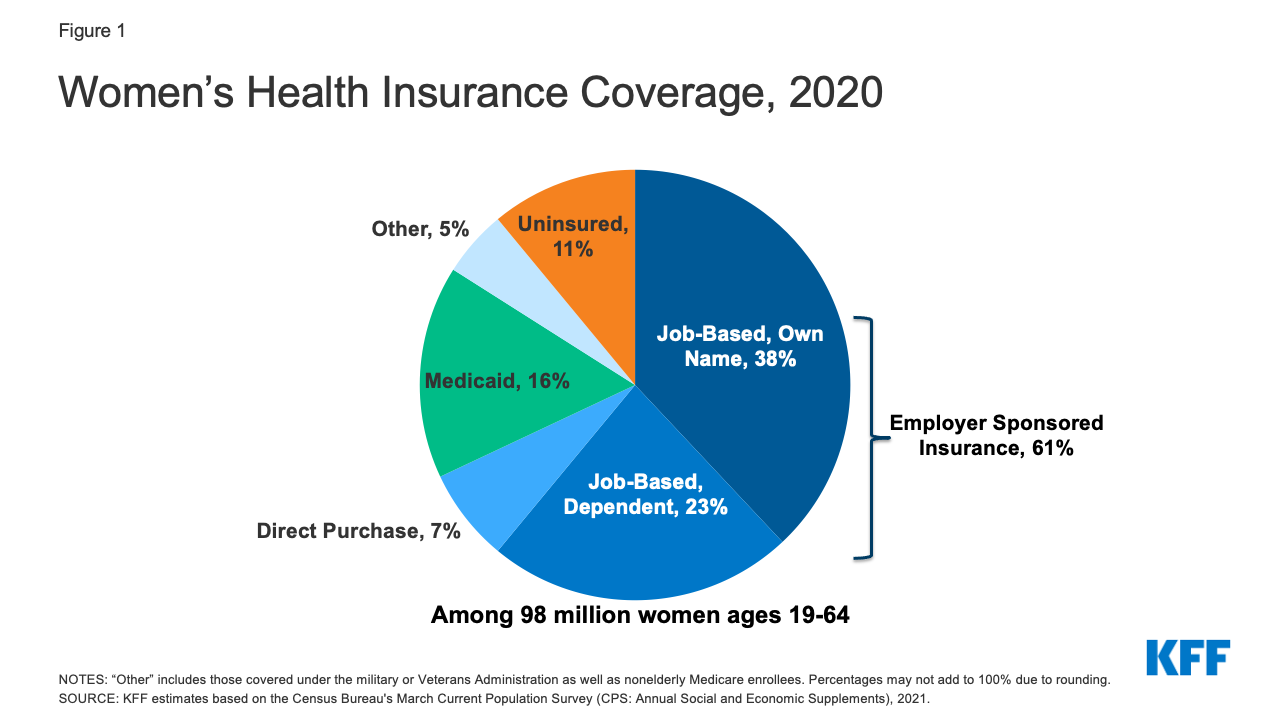

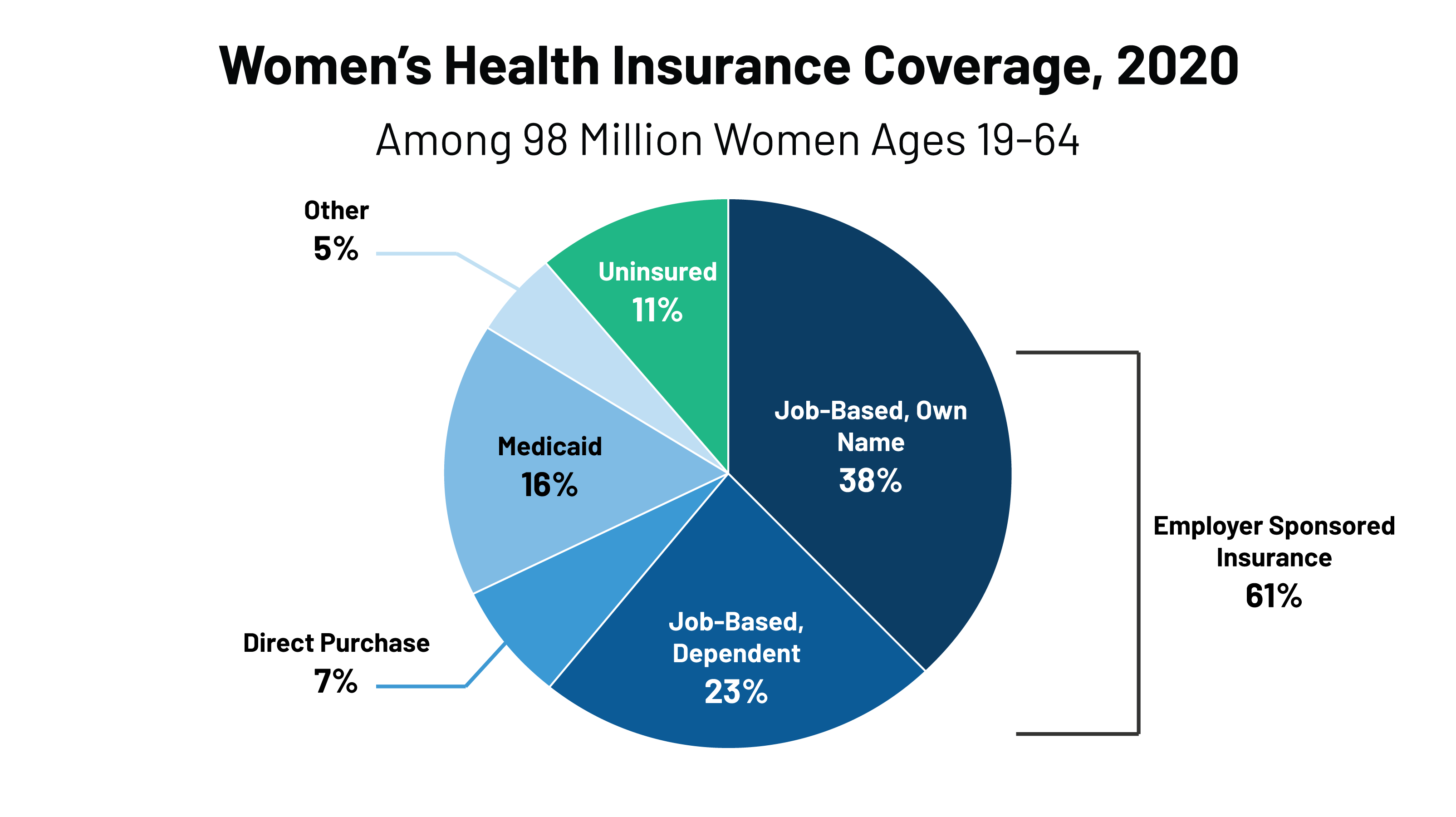

Women S Health Insurance Coverage Kff

Is It Worth Having A Hdhp To Be Eligible For A Health Savings Account

How A Deductible Works For Health Insurance

High Deductible Health Plan Hdhp Pros And Cons

No Deductible Health Insurance What You Need To Know Clearsurance

What Is Coinsurance 9 Mysteries Of Health Insurance Solved Black Women S Health Imperative

Choosing Between A Low Or High Deductible Health Plan

How A Deductible Works For Health Insurance

Insurance Guide 2018 Oregonians Flock To High Deductible Health Plans Oregonlive Com

/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)

Life Vs Health Insurance Choosing What To Buy

How A Deductible Works For Health Insurance

If You Re Expecting To Have A Baby Or Large Health Expenses In The Near Future Sometimes It S Worth Paying For The Low Deductible Health Plan Rather Than The High Deductible Health Plan

High Deductible Health Insurance True Cost Of Healthcare

Women S Health Insurance Coverage Kff

What Do High Deductible Health Plans Really Mean For Hospitals Healthcare Finance News

High Deductible Health Plans Create Cost Related Barriers To Care