peoria az sales tax calculator

How Does Sales Tax in Peoria compare to the rest of Arizona. If youre an online business you can connect TaxJar directly to your shopping cart and instantly calculate sales taxes in every state.

Arizona Gasoline And Fuel Taxes For 2022

This includes liquor licenses pawn shop licenses.

. Multiply the price of your item or service by the tax rate. This resource can be used to find the transaction privilege tax rates for any location within the State of Arizona. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax.

Below are the tax rates for various categories effective July 1 2014. The base state sales tax rate in Arizona is 56. ICalculator US Excellent Free Online Calculators for Personal and Business use.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Sales Tax State Local Sales Tax on Food. The latest sales tax rates for cities starting with P in Arizona AZ state.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Arizona local counties cities and special taxation districts. Peoria in Arizona has a tax rate of 81 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Peoria totaling 25. The December 2020 total local sales tax rate was also 8100.

Apache County 61 percent. Find information on obtaining a business license or sales tax license in the City of Peoria Arizona. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal.

This includes the rates on the state county city and special levels. Maricopa County 63 percent. A full list of these can be found below.

Arizona Tax Rate Look Up Resource. As of 2020 the current county sales tax rates range from 025 to 2. When combined with the state rate each county holds the following total sales tax.

Current Combined Tax Rates Peoria State and County Effective July 1 2014. Peridot AZ Sales Tax Rate. Find your Arizona combined state and local tax rate.

The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. 85345 85380 85381.

Skip to main content. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Peoria AZ. Local tax rates in Arizona range from 0 to 56 making the sales tax range in Arizona 56 to 112.

Sales Tax Calculator Sales Tax Table. Use the physical address or the zip code or if it is unknown the Map Locator link can be used to find the location. The average cumulative sales tax rate between all of them is 841.

Peoria AZ 85345 Monday - Thursday. Look up 2022 sales tax rates for Peoria Arizona and surrounding areas. City and County Additions.

Tax rates are provided by Avalara and updated monthly. All rates are shown as percentages. Arizona sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112. Get immediate access to our sales. The Peoria Arizona sales tax rate of 81 applies to the following six zip codes.

The average sales tax rate in Colorado is 6078. Peoria is located within Maricopa County Arizona. Look up 2022 sales tax rates for Peoria Illinois and surrounding areas.

The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience. If you are unsure what classification your business falls into please refer to our brochures below for more details. SalesTaxHandbook visitors qualify for a free month by signing up via our partner program here.

Cochise County 61 percent. The sales tax rate does not vary based on zip code. Real property tax on median home.

Pinal County 72 percent. The Peoria Arizona Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Peoria Arizona in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Peoria Arizona. The average cumulative sales tax rate in Peoria Arizona is 81.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Rates include state. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Look up any Peoria tax rate and. Method to calculate Peoria sales tax in 2021. Peoria County is located in Illinois and contains around 16 cities towns and other locations.

Tax rates are provided by Avalara and updated monthly. Petrified Forest Natl Pk AZ Sales Tax Rate. How to Calculate Sales Tax.

Then use this number in the multiplication process. You can find more tax rates and allowances for Peoria and Arizona in the 2022 Arizona Tax Tables. Method to calculate Peoria sales tax in 2021.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. You can use our Arizona Sales Tax Calculator to look up sales tax rates in Arizona by address zip code. Peoria AZ Sales Tax Rate.

Within Peoria there are around 6 zip codes with the most populous zip code being 85345. Select the appropriate business description and the statecounty and city if. Sales Tax Calculator.

The Sales tax rates. The Peoria Sales Tax is collected by the merchant on all qualifying sales made within Peoria. Gila County 66 percent.

The average sales tax rate in Arizona is 7695. The current total local sales tax rate in Peoria AZ is 8100. Effective June 1 2019 Friday.

As for zip codes there are around 43 of them. For more information on vehicle use tax andor how to use the calculator click on the links below. Divide tax percentage by 100 to get tax rate as a decimal.

Find list price and tax percentage. The Peoria Arizona sales tax is 810 consisting of 560 Arizona state sales tax and 250 Peoria local sales taxesThe local sales tax consists of a 070 county sales tax and a 180 city sales tax. Skip to main content.

Arizona has a 56 statewide sales tax rate but also has 80 local tax jurisdictions including. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Groceries are exempt from the Peoria and Arizona state sales taxes.

Arizona Sales Tax Rates By City County 2022

Peoria Arizona Az Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

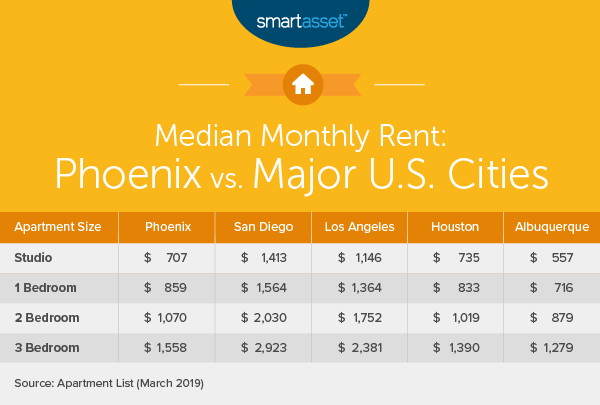

Cost Of Living In Phoenix Smartasset

2021 Arizona Car Sales Tax Calculator Valley Chevy

Peoria Arizona Az Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Arizona Sales Tax Guide And Calculator 2022 Taxjar

Arizona Property Tax Calculator Smartasset

Arizona Sales Reverse Sales Tax Calculator Dremployee

Is Food Taxable In Arizona Taxjar

Rate And Code Updates Arizona Department Of Revenue

Peoria Arizona Az Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Olin Business Solutions Pllc Az Sales Tax Calculator Obs Is A Licensed Cpa Firm Providing Accounting Services In Yuma Arizona

2021 Arizona Car Sales Tax Calculator Valley Chevy

Olin Business Solutions Pllc Az Sales Tax Calculator Obs Is A Licensed Cpa Firm Providing Accounting Services In Yuma Arizona